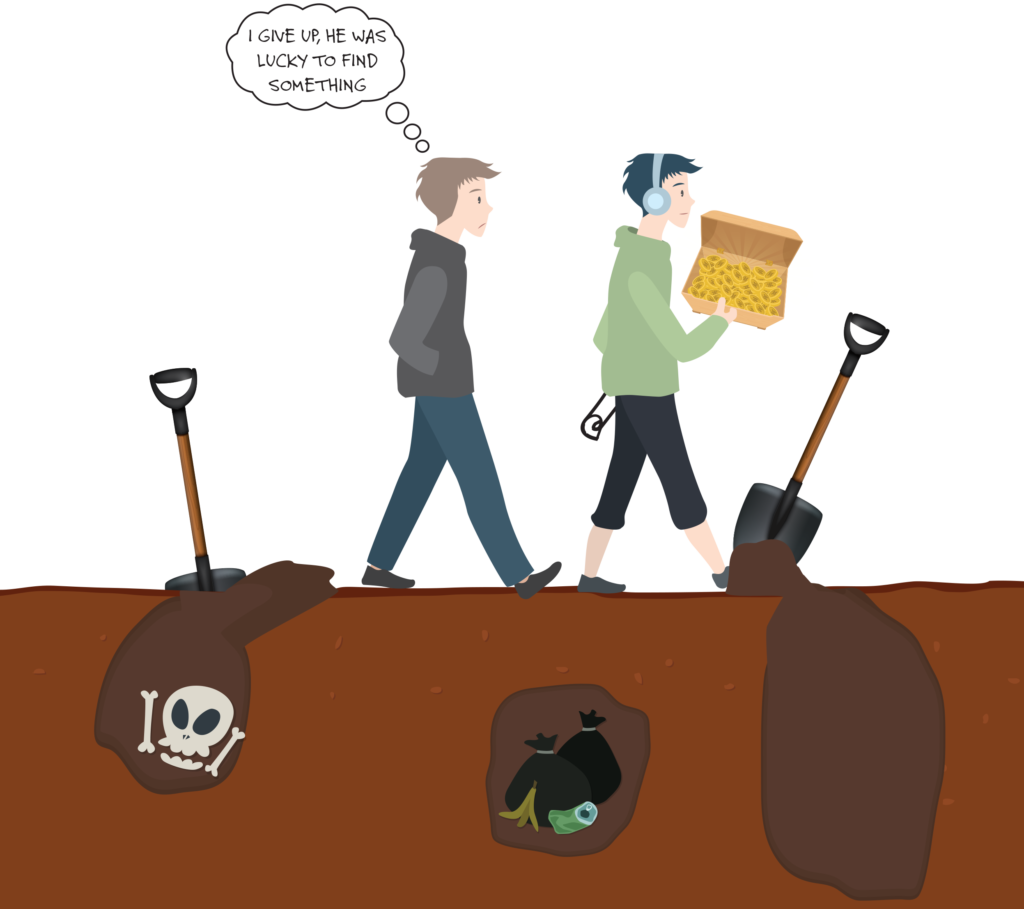

People often wonder why they haven’t caught their “break” yet. They’re waiting for that moment when they’ll hit it big and everything will be like they dreamed.

I wanted to give a brief look at why it’s not some random occurrence. Breaks don’t just come along and say, “welp, I guess it’s Tommy’s turn today!”

In this post you’ll see why continually placing bets and investing in yourself is the only way to play the game.

I’ll share some of my successes and failures so you can understand more about how the specific roads I chose led to any breaks that I got. I’ll also talk about the other roads I could have chosen, which would have clearly led to different outcomes.

Let’s look back to high school. When I was in high school I didn’t understand why all my friends were getting jobs.

“Wait, you’re going to make $5/hr? Why are you doing it then?”

“Well, I need to build up my resume, plus I need the money.”

“Build your resume? What college is going to want you because you worked an entry level job?”

I always asked my friends why they didn’t work for themselves. “I don’t know what to do,” they’d answer.

“It’s easy”, I’d say. “I’ll help you”. While intrigued, most didn’t want the “risk” of going outside the traditional route.

I had started a sports card business in high school. It kind of started by accident initially, and eventually became a business where I made significantly more than I would have made in a job. The obvious side effect of that was I learned some things about business pretty young, and the benefits of taking “risks”. I mean, it was mainly a hustle business- buy for X, sell for Y. So, my business knowledge was still pretty novice, but it was a good starting step.

Occasionally I’d hire one of my friends for an extra job when I needed help transporting a collection.

“UPS is going to charge $600 to get it by next week!? F that, me and my buddy will have it to you tomorrow for $400.”

I remember one time when I had just sold a collection for like $5k. I cashed the check because cash was way cooler than looking at the number on a bank statement. Then when I went to school the next day, I was like, “wait, what if someone robs the house while I’m at school? No one will be home.” So I threw the money in my pocket and went to school.

I remember talking to a buddy at lunch and showing him.

It always interested my friends, but besides the perceived risk, the first step was always what kept them out.

“What would I sell?”

“There’s lots of stuff you can sell.”

“I wouldn’t even know where to start”

The first step is the step that would often teach people the most, but it’s the one they refuse to take.

There’s always opportunity.

Heck, I remember several years later when elmos got hot.

At that point in my life I was busy with college or poker or something, so I called my brother up and told him to go buy out every store that had them and we’d split the profits. The prices on ebay were significantly marked up because stores couldn’t keep them in supply. So he drove around everywhere buying up all the elmos he could find, and I’d market them on ebay.

Opportunities are never hard to find, it’s just that you see a lot more of them when you’ve played the game before.

It’s less about opportunities existing, more about you recognizing them and knowing what to do so you can capitalize.

I learned that quickly as a kid. “How is everyone else not seeing all the ways they could make money?”.

Again, most of the opportunities I saw at that age were just opportunities based on hustle. But still, opportunities nonetheless.

Plus you learn quickly.

“Oh shit, I paid $2k for this collection and I may not make a profit on it?… Hmmm, did I pay too much? Am I marketing it poorly?”.

Feeling the lessons, and reading about them in a book or blog are completely different.

That’s why people with ‘book knowledge’ who have never played the game can sing the song all they want, but they don’t actually understand the lyrics they preach, which is why many of their lessons are flawed.

In college the whole ‘get a job for small pay + resume’ game went up a notch.

People wanted to pad their resumes with things that would look good to a potential employer. Me? I wanted to make money and get smart. Not school smart though, money smart. I spent more time reading ‘get rich’ books than I did textbooks. Entrepreneur biographies, real estate books, poker books, whatever I thought might help me get where I wanted to go.

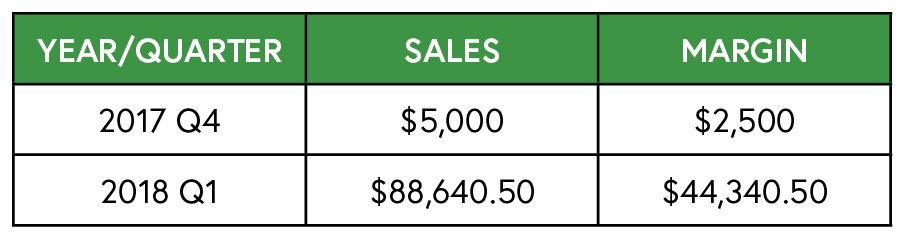

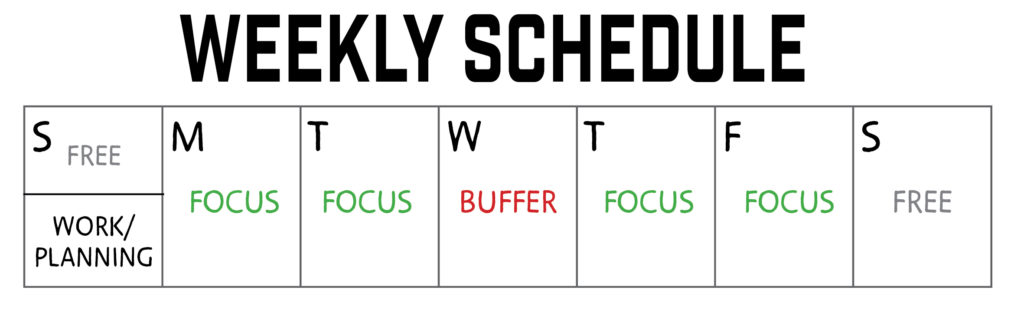

While other people were working some job for pennies to get a better resume, here was a sample summer for me:

I was interning for free for the Philadelphia 76ers, playing poker for money to pay for it, while learning to start a new business in my spare time(opportunity I saw in the poker space), while occasionally using my off days from the internship to do things like auditioning for The Apprentice.

Who do you think is likely to come out ahead in the long run? The guy who spent his summer like that, or the guy who got a job where others told them what to do and gave them a small sum of money for the privilege.

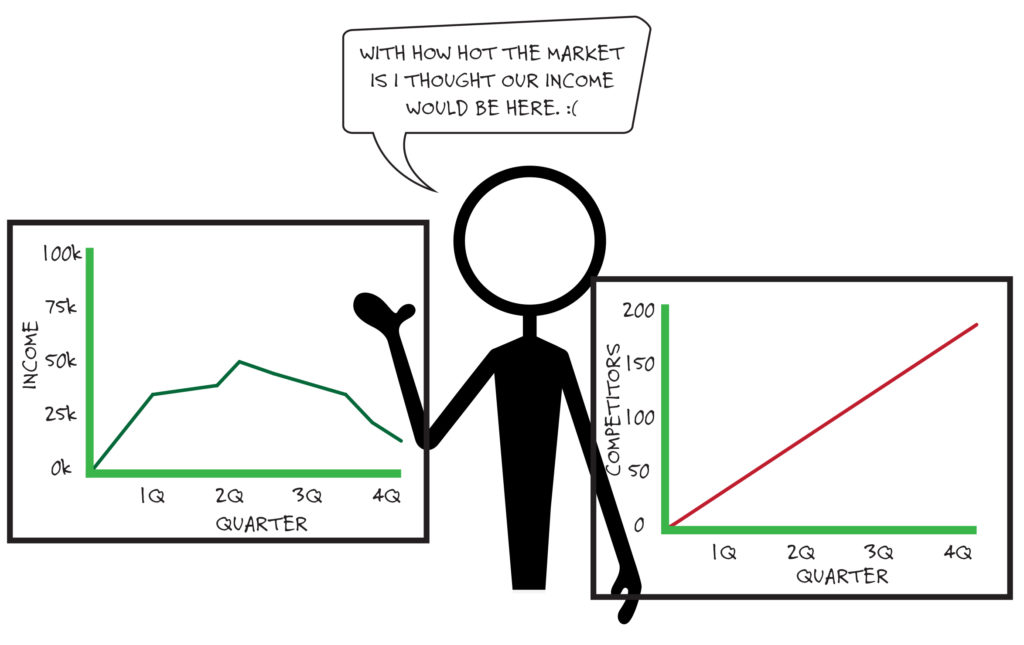

How most spent their summers:

What happened from these things:

- Learned I didn’t want to work for an NBA team like I thought I did. That’s not a bad thing, it’s a great one. I learned I likely wouldn’t make the money I wanted to make for a much longer time than I hoped. So, I would have had a cool job that I liked, but not be able to afford the life I wanted to live.

- Standing in line for The Apprentice auditions for hours allowed me to meet the first entrepreneurs I’d really ever met in my life. One of them introduced me to Rich Dad Poor Dad, which was the first book I’d read like that which got me interested in owning assets. I never got a call back from the audition, but the education I got from standing in line for hours was awesome.

- Learned a lot about business from getting, and then losing an exclusive licensing deal on a new poker product I wanted to bring to market.

- Got even better at poker and starting making decent money(which would give me more confidence in going pro later on)

Each of these lessons lead me to being closer to the path where I wanted to go, and gave me knowledge for the next times I bet on myself that I wouldn’t have had otherwise. Some people would look at a summer like that and think I wasted it away failing 75% of the time. I saw it as four out of four lessons. I learned all sorts of things I never would have known had I not made attempts at those opportunities. The knowledge I picked up allowed for more optimal decisions moving forward.

More optimal decisions either lead to successes, or more education from failure that continues to compound your knowledge, which will eventually lead you to successes.

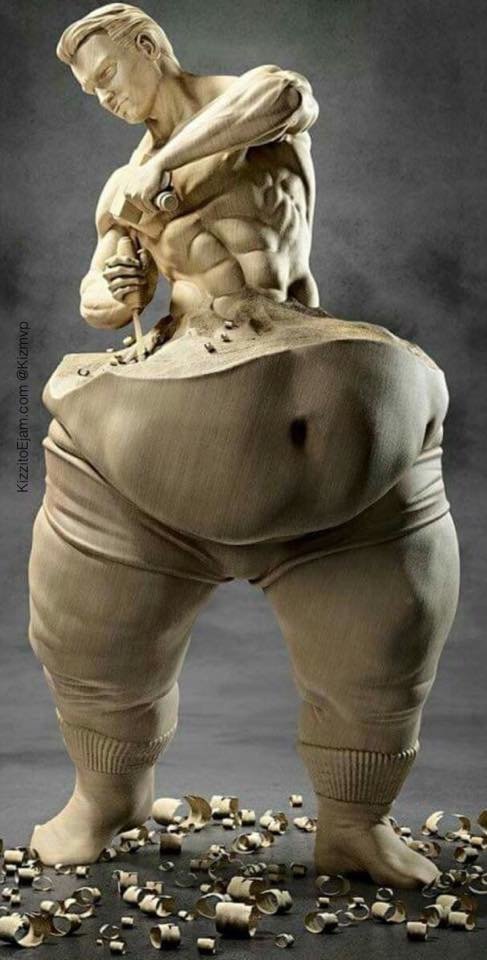

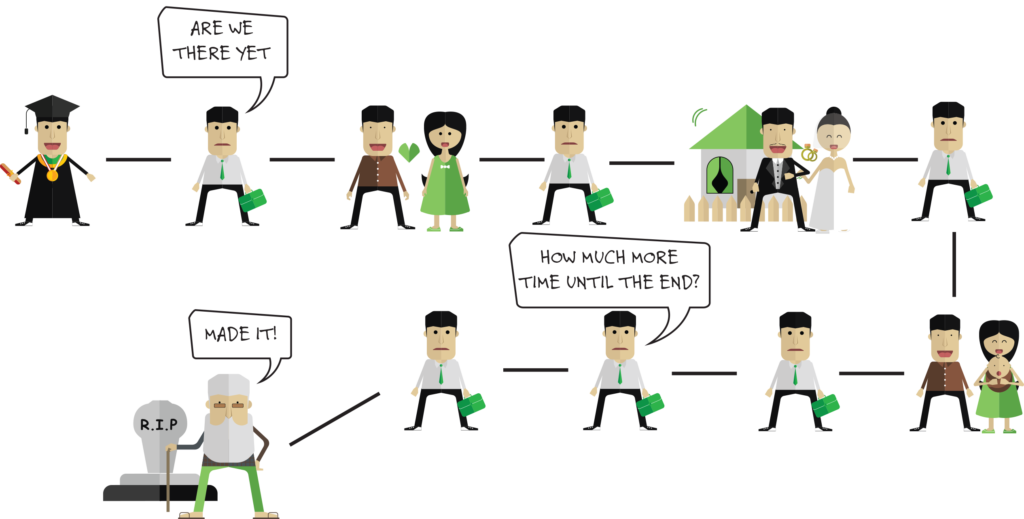

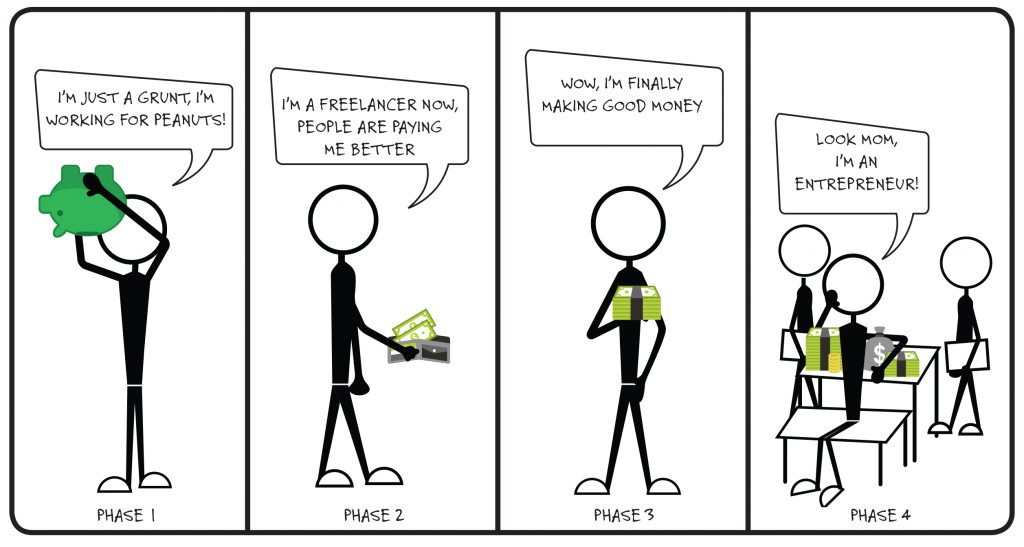

Example life of someone who achieves success:

- Failure

- Failure(but smarter)

- Failure(but even smarter)

- Failure(but REALLY smart)

- Success(NOW I get it!)

Example life of most people:

- Traditional route

- Traditional results

- Seeing results they’d rather have… “I wish I was lucky!”

When people see any level of success their initial thoughts are often: “Oh you’re so lucky you’re good at poker”, “Oh you’re so lucky you’ve started some businesses that printed money”, “Wait you started 20 e-commerce stores? Omg could you be luckier!”, “You travel anytime you want? What I would give to have your life!”.

The truth is, all your decisions in the past have answered exactly what you are willing give. It is often not much, which leads to you not having your desired life.

See, if you take the standard road, how can you possibly think you will get anything but standard results?

If you look at my poker career, playing poker to earn an income was anything but standard.

I started out playing for pennies. Literally pennies. I had a notebook I was supposed to use for taking notes in class. I used it to track my poker results.

+$0.13

-$0.21

+$0.25

-$0.06

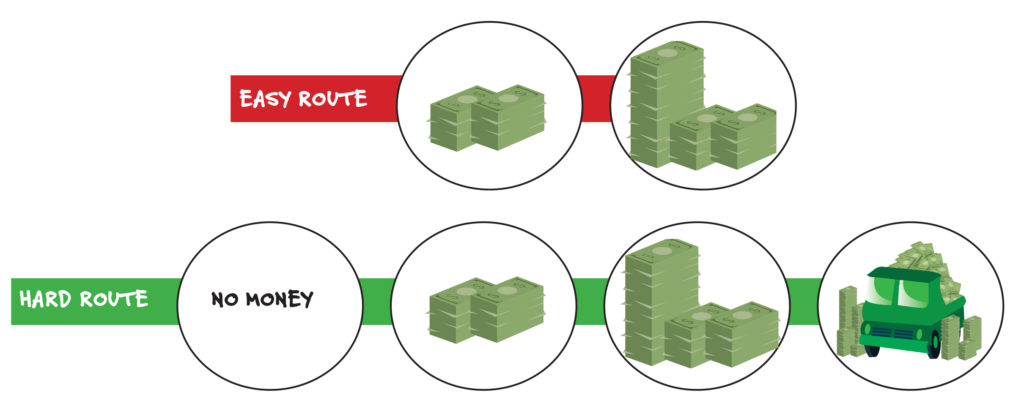

Eventually I got better as a result of spending a ridiculous amount of time playing and studying the game. I did the $0/hr work that no one wants to do. When I wasn’t in class or playing sports, I was playing or studying poker. I’d play in between classes, after classes, at lunch, before bed. After a while it started paying off. I started making decent money. I’d hear “beginner’s luck” from anyone who didn’t understand how much time and focus I was investing getting better at the game.

The internet in the dorm sucked sometimes, so I’d go over to the library after classes, giggle to myself surrounded by people working hard on class assignments, load up some poker tables, print some easy money and head back to the dorms. I remember I jammed up the printers one time with hundreds of pages worth of poker hands I printed out to review.

“Dude I’ve got to print my paper how long is that gonna take? What is all that!?”

“Uhh…. homework!”

Using school resources to gamble and then review my gambling strategy… Let’s just say I wasn’t up for valedictorian.

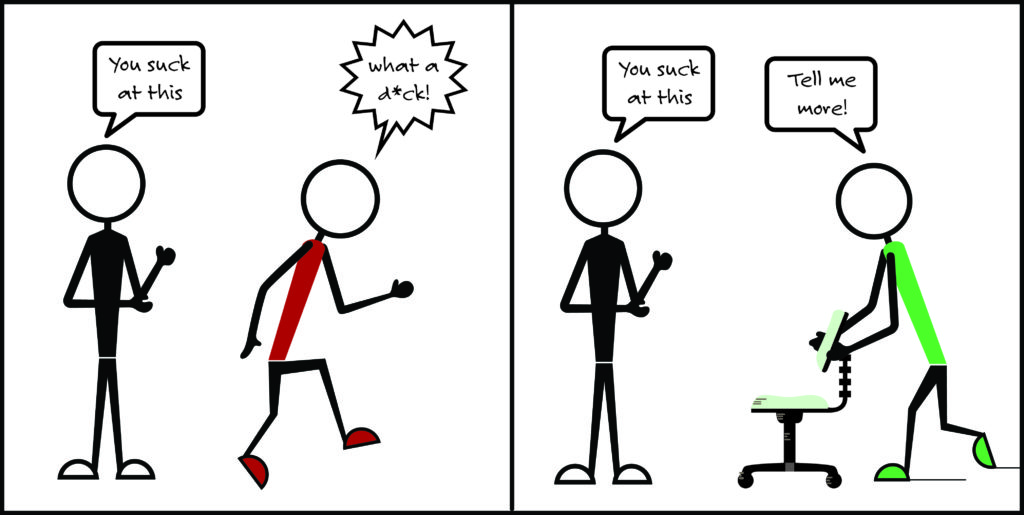

Similar to how the feedback for entrepreneurship goes, poker went something like this:

Just learning to play: “That’s risky. You’re going to lose your money”

Starting to make a little money: “That’s what everyone says in the beginning. It’s beginner’s luck!”

Making good, consistant money: “Hey, can you teach me!?”

While I was learning to play for pennies, slowly moving my way up while risking my own money, and studying how to get better when I wasn’t playing, other people were doing the normal small hourly job stuff.

We were both ‘working’, but as you’ll notice I have a pattern of betting on myself, instead of asking others to rent my time.

In doing things for myself I get significantly greater rewards when things work out, and more importantly, much greater lessons. When you’re the one taking the ‘risk’, you’re committed. If you lose money on something, you’ll want to figure out why you’re losing it pretty quick, or you’re just going to lose more.

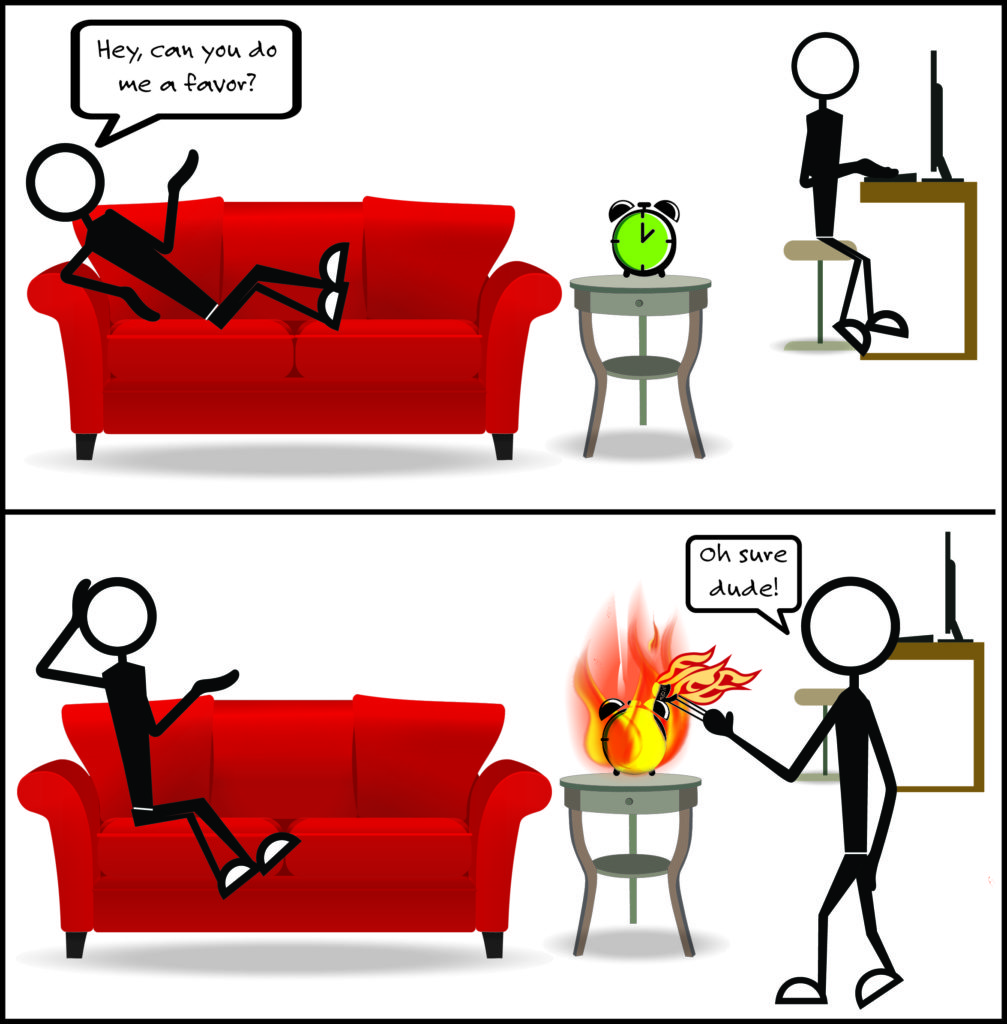

You know how many ‘can you take me under your wing and teach me everything you know for free’ emails I get? How committed do you think those people will be? They won’t be at all. The first barrier they run into they’ll quit, because they have nothing invested.

In consistently betting on yourself you develop a pattern of understanding that bad things don’t happen when you take calculated risks. If you never play the game, you have a false assumption that everything is risky and “omg what if XYZ happens?”.

Well, what if it doesn’t?…

Significantly better results than others, plus significantly more learning and higher level skills you acquire. Those will continue to snowball into significantly better results in the future since you’re able to think on a higher level than the people who have never taken risks and never acquired certain lessons.

After college when everyone else got their ‘safe, secure’ job, I got a 100% commission based job as a loan officer. So, I got paid $0 until I sold something. I was able to use my poker and sports card profits to fund the risk. Well, this one didn’t go so well. It felt like boiler room. I love the movie but didn’t want to live it. 12+ hour days of dialing for dollars. I had to hustle up my own creative ways to get leads once I realized the leads I got from the company were worthless. The company was giving us ‘penny leads’ instead of the high quality leads we were promised. I guess they figured any sales generated were pure profit for them since we were on 100% commission. Not exactly long term thinking, and definitely not what I signed up for.

This situation wasn’t going to get me where I wanted to go.

There was one point I was driving 1.5 hours each way everyday plus working 12+ hours, so I literally wasn’t doing anything except for working, driving and sleeping. I don’t mind the grind if there’s a payoff or purpose, but this wasn’t it.

Despite doing ‘well’ compared to others who started at the same time as me, it was still pennies. Besides not getting the leads we were promised, there were a lot of extra “fees” outside of the normal fees that were taken out of deals by sketchy bosses. A call to corporate confirmed I was getting hustled.

Those five figure months I was expecting straight out of college were nowhere in sight. After finally realizing I was sold a dream that wasn’t reality, I got out. At the time I only felt anger at the false promises and getting taken advantage of, but looking back it was a great lesson in the necessity to perform proper due diligence and be able to reverse engineer what someone is saying to understand if it’s feasible, or if you’re being sold bullshit. It’s probably part of the reason I’m passionate about helping you learn how to think more optimally, to avoid the BS and avoid falling victim like I did when I was just starting out.

Most people at this point would lick their wounds and get into that ‘safe, secure’ game. Let’s go grab a job and X off the next 30 years on the calendar.

F that.

Was time to bet on myself again.

I wanted to see what was possible for myself in poker. I remember when I was about to quit the loan officer job I was chatting with one of the veterans of the office. He was a real slick talking, smooth selling guy. Talked fast, and talked a lot- he was like the Conor McGregor of mortgage brokers, minus the hustle.

He showed up like once or twice a week for a few hours here or there, closed a deal and then went out chasing girls. He’d built enough leads up over the years that he didn’t have to hit the phones, and didn’t seem to have higher aspirations.

“I’m probably going to quit and play poker full time”, I told him when the bosses weren’t around.

“No you’re not! How are you going to make money?”

“Playing poker. I’m working for pennies here, I’ll make more going all in on poker.”

“You can’t make real money at poker!”

“I guarantee I can. I’ll make 6 figures year 1 if I do it full time.”

“Bullshit, you’d already be out of here if that was true.”

A few days later I was gone.

The beginning of my ‘pro poker’ journey didn’t start like I’d hoped. I made $0 my first month. Literally no money. So, not much of a “pro” at that point. I was rusty and the games had gotten a bit tougher since I’d last played regularly.

So, despite the ‘normal’ tendency to quit and start renting out time, I went the opposite way and bet even more on myself- I hired a coach to help me raise my game.

I’ve been shown “you can give up now” signs over and over, but have always kept betting on myself because I understood that not betting on myself was the worst bet of all.

It’s important to note that a lot of my willingness to continually bet on and invest in myself is because of the experience in doing so in the past, all the way back to when I was a kid.

Why is most people’s natural tendency to avoid risk, and mine to make the optimal decision? I think a lot of it has to do with most people never having experience betting on or investing in themselves, so it feels uncomfortable and unnatural.

Many people assume that “one day” that will magically change, but it won’t. It’s always going to feel unnatural the first time.

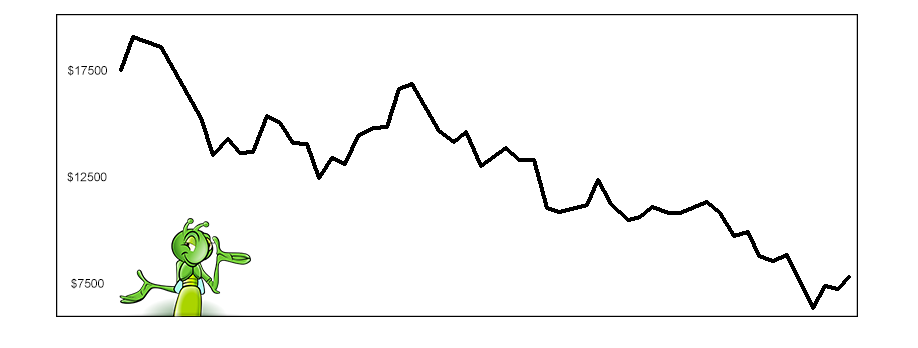

My 2nd month as a pro, and I guess you could really say it was my first since I didn’t make any money the month before, I made over $17,000.

A lot of people hear that and say, “oh, so lucky!”. Well, want to know where the “luck” came from? Putting in a ton of hours in college not just playing but learning the game, hiring people who were better than me to train me how to get an edge in the current games, and putting an ungodly amount of hands in.

What would seem like an “overnight success” to the outsider, was anything but.

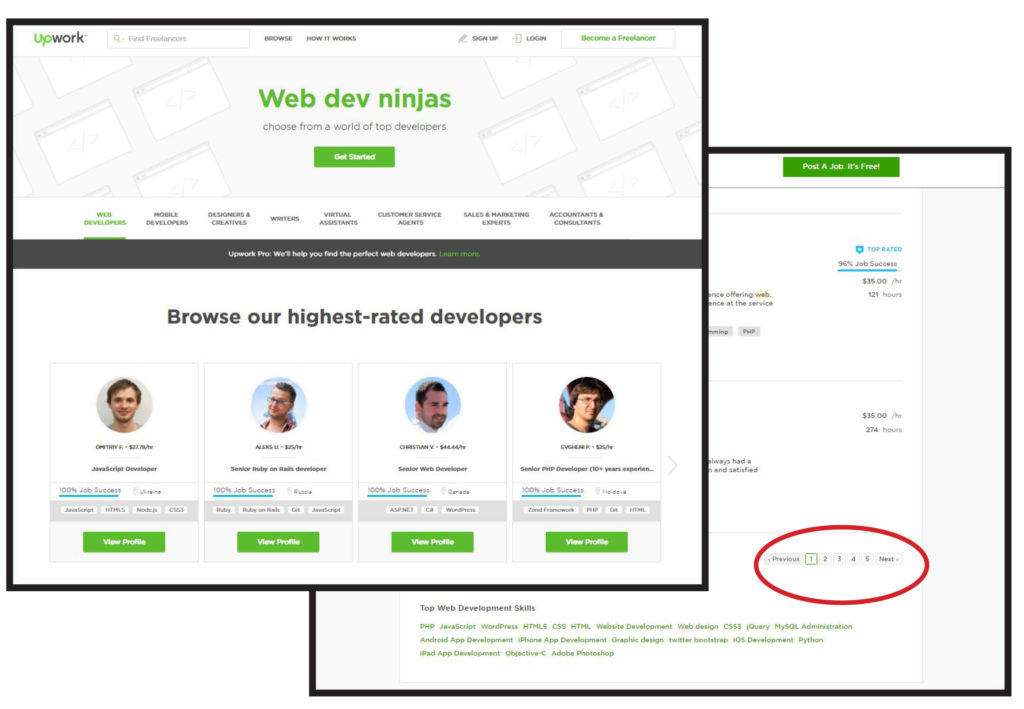

What I didn’t have yet in skill, I made up for in hustle. To make the $17k, I played over 88,000 hands that month.

At the time, it was more hands than just about anyone had played. I wasn’t gambling massive amounts of money to try and win a few big pots, I was playing small stakes, and a lot of tables at once. I was just hustling harder than anyone else, and pushing my small edges over and over and over and over… 88,000 times. A decent chunk of my profit was in bonuses and kickbacks from the poker rooms for playing so many hands.

I may have made $17k, but I still failed a lot that month. There were plenty of hands I had no idea what to do and felt lost.

I lost a lot of hands I shouldn’t have. I would send any hand I struggled with to my coach, and throughout the month got better and better.

I wasn’t just interested in what to do. I wanted to know how to think.

“Did I play this hand right?”, “why did you recommend raising here, but not here?”, “are you sure I should fold in that position?”, “why wouldn’t you call and make a play at him after the flop?”.

I grilled him in every which way, because I understood that memorizing answers would only get me so far. I needed to understand the thought process behind it so that I could continue to reap benefits with or without a coach.

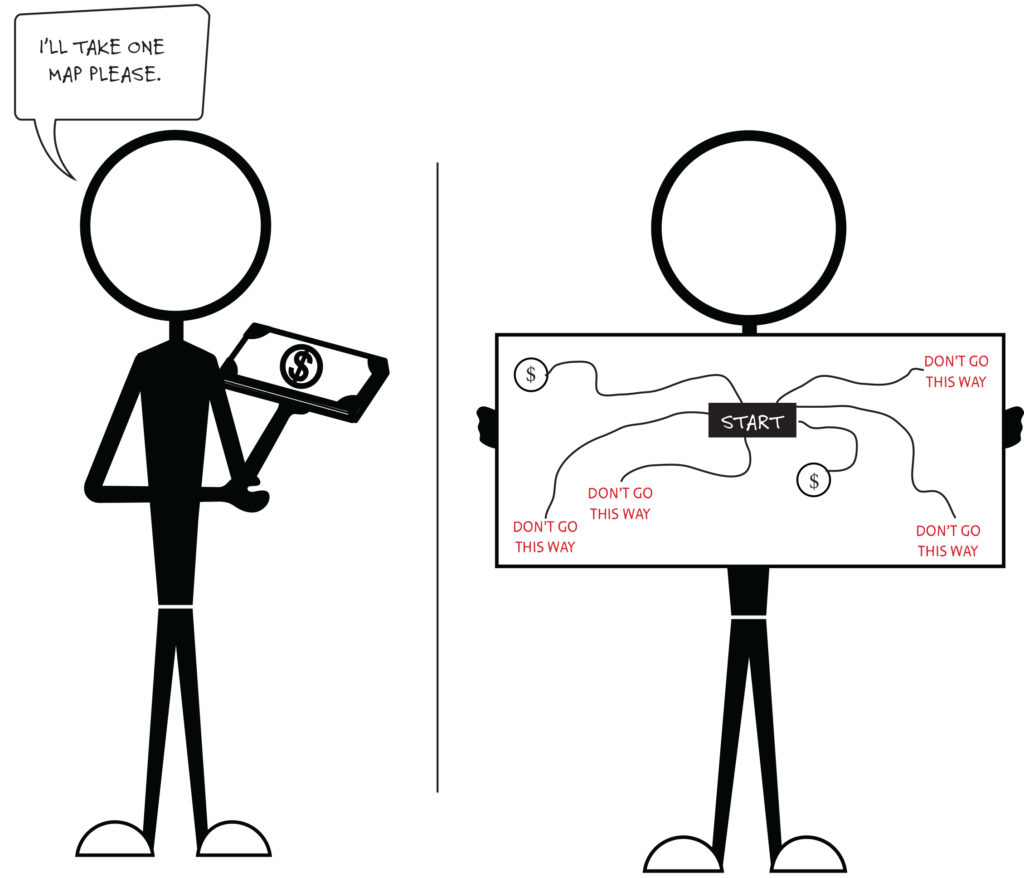

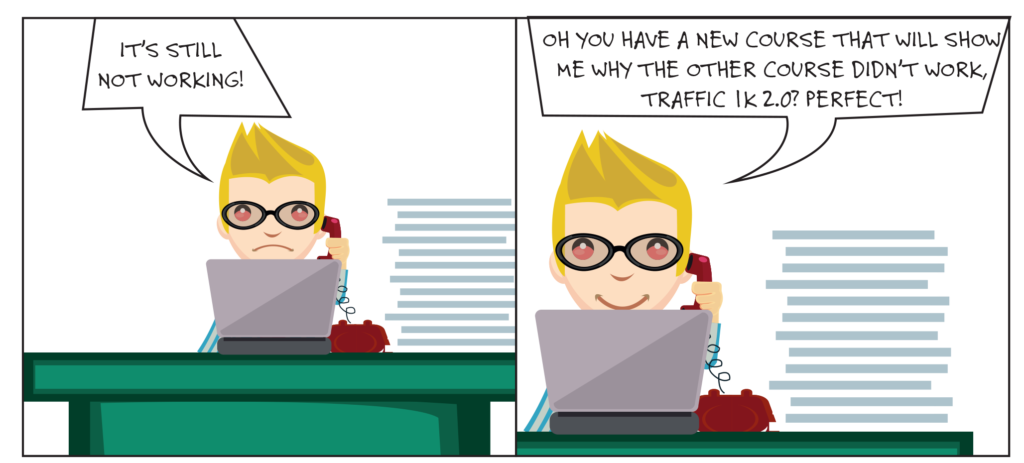

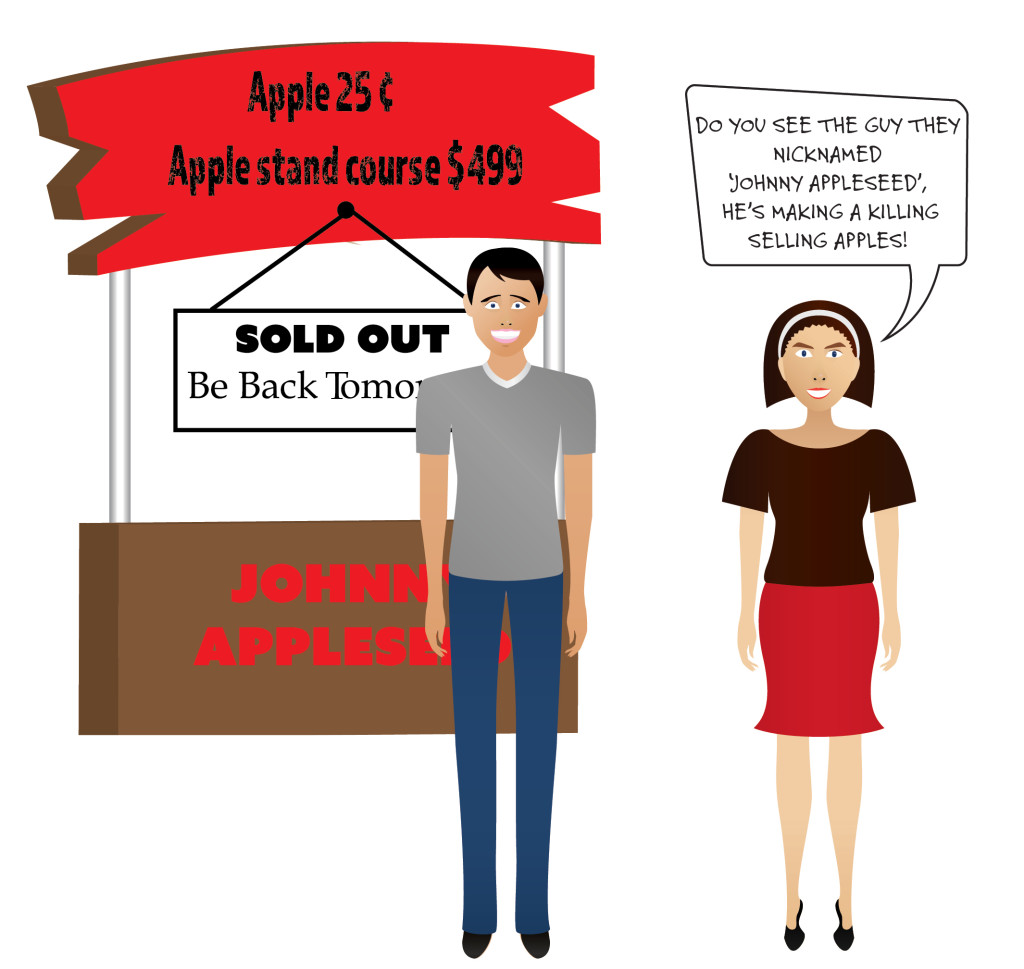

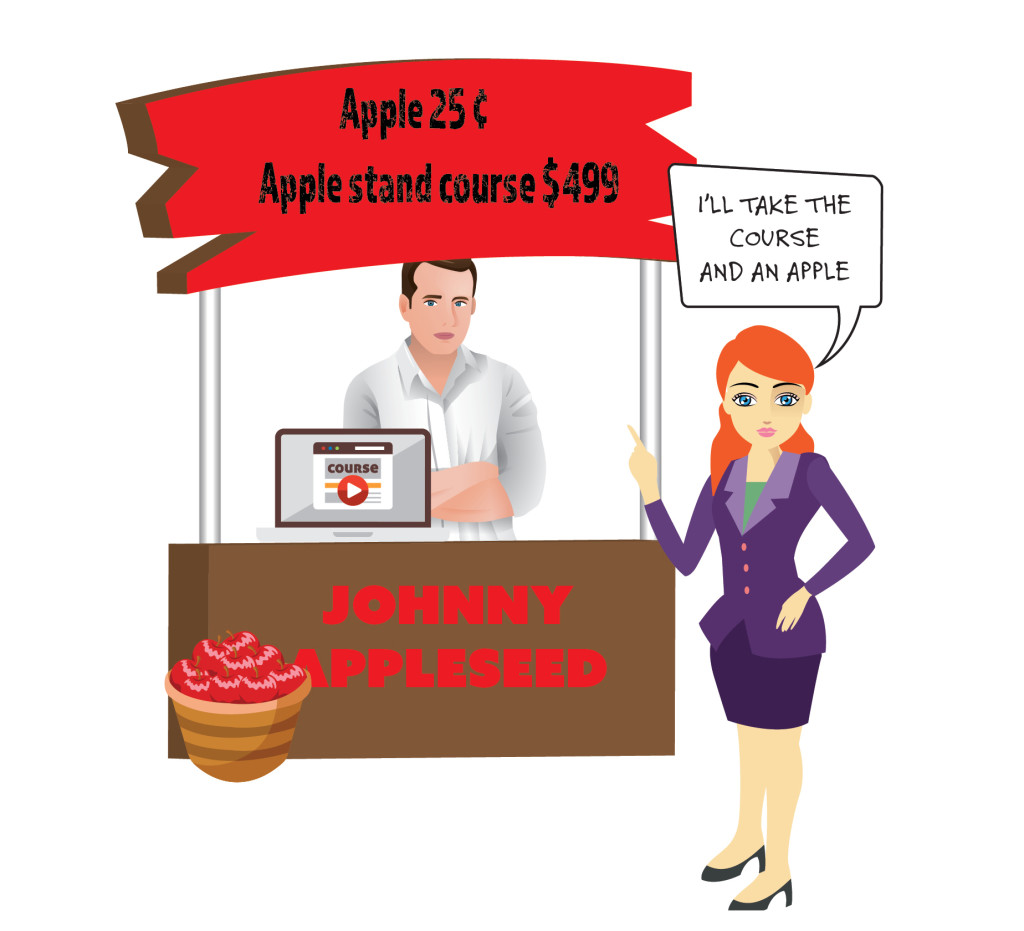

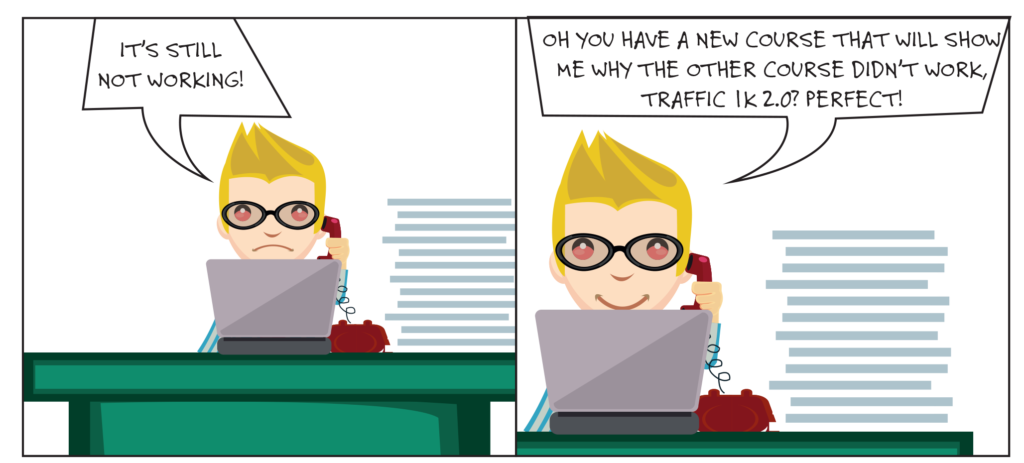

This is something most aspiring entrepreneurs fail to do. It’s comically bad in the entrepreneur/make money space online.

“Ohh, I should start a blog? Oh I should start a podcast? Okay!”

People wait to be told what to do, not understanding the real upside or downside of the route they’re choosing. They never learn to think, and because of that blindly follow whatever advice is given to them, even if it’s crappy advice.

The blind pay the blind to lead them, never understanding why they’re going the route they’re going, and most never even stopping to question it.

Throughout poker I hired many coaches. Sometimes it was just to get a different perspective, sometimes it was raising the level of coach I was hiring as my own level rose, sometimes it was higher stakes players who were crushing a certain game I was moving to.

Poker was a bet that paid off big. Many people I knew were struggling with low paying jobs they didn’t necessarily enjoy and no vacation time, while I got to play poker and was taking off for weeks at a time to travel if I wanted, and had given myself the capital to make more bets on myself.

Once I got rolling with poker, I can remember thinking of potential real estate goals…

“If I can keep hustling at poker, I could leverage and try to buy a new house every month!

Hmm… should I just keep my money safe and sound in a bank?

Lol, mediocrity thoughts.

Let’s bet on myself!”

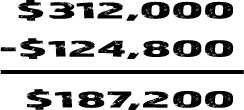

Well, despite negotiating some very good deals, my real estate bets happened at one of the worst times in real estate history.

In your mid 20s and taking a six figure hit on an investment… I didn’t love it!

Many of the people I’d went to school with were moving along with their jobs, being promoted, and here I was losing close to their career earnings in one shot.

Just another bet that went heavily against me.

Stuff like that can be hard to shake off.

Logical Billy doesn’t let that Billy out much.

“Keep betting on yourself.”

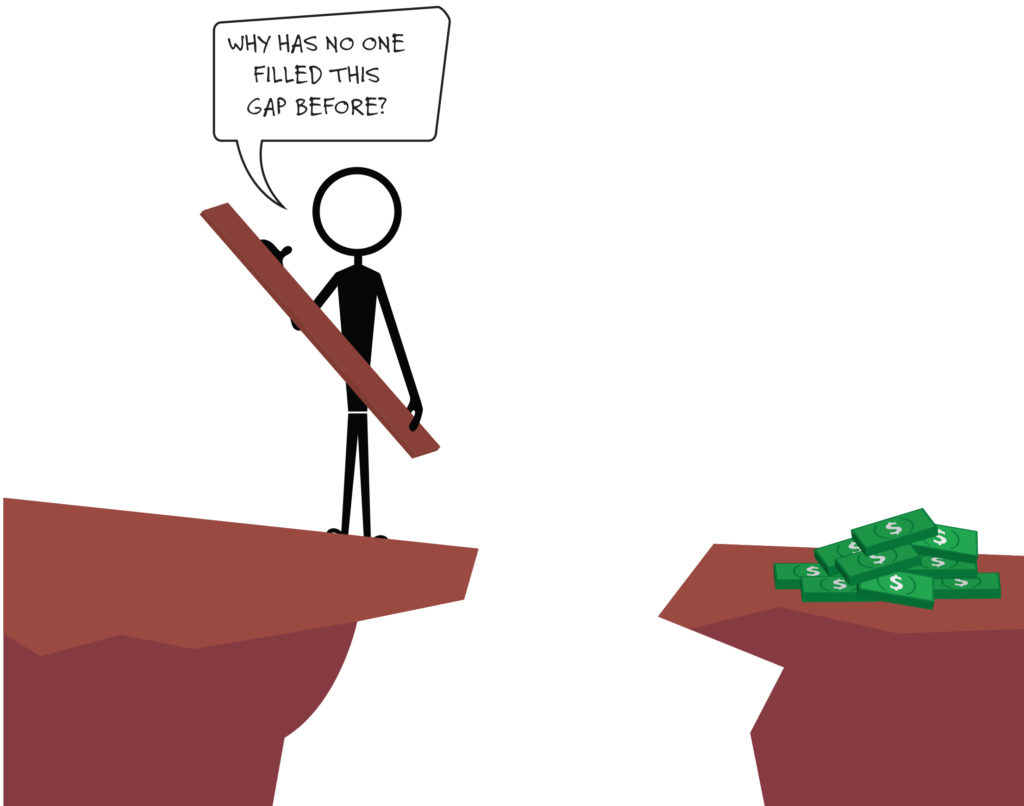

From being in poker so long I saw gaps in the market that others weren’t filling well. I wanted to launch something to fill one of those gaps.

I had multiple people tell me before I started the venture that it would fail. The same way many did when I started playing poker. If I hadn’t bet on myself in the past I might have let those opinions scare me away.

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.

― Theodore Roosevelt

I launched the poker ventures and quickly turned it into a 7 figure business. I’d obviously had the sports card business as a kid, and multiple other ‘hustle’ ventures, but this was probably my first “real” business.

I heard how “lucky” I was from many different people.

Some of these were the same people who told me I wouldn’t succeed if I tried.

Want to know where the “luck” came from?

I identified gaps in the market based on understanding the current market extremely well and doing massive amounts of due diligence. I’d been putting in hours upon hours upon hours for a very long time in that industry so I knew the ins and outs, and decided to place a bet that I was right. It was the same bet that anyone else could of made, but they either couldn’t see the opportunity, or didn’t understand how to make it happen.

This isn’t me stroking my own ego at all. I’m sure some other entrepreneurs might have been just as successful with it. The ones that would have spotted it and known how and why to pull the trigger were probably just not in that market, or were just busy making other bets.

I’m just trying to enunciate where any success comes from.

“Luck” seems like an easier answer though, and is something that will make people not betting on themselves feel better about sitting on the sidelines. They don’t see the losses and the lessons behind the scenes that teach you the necessary skills to get to the wins.

“Winners win because they persevere in doing what losers would not even begin doing in the first place… and practice repeated effort even in the face of little or no observable progress in a commitment to systematic practice that yields “instant results” to the unaware outsider.” – George Pratt

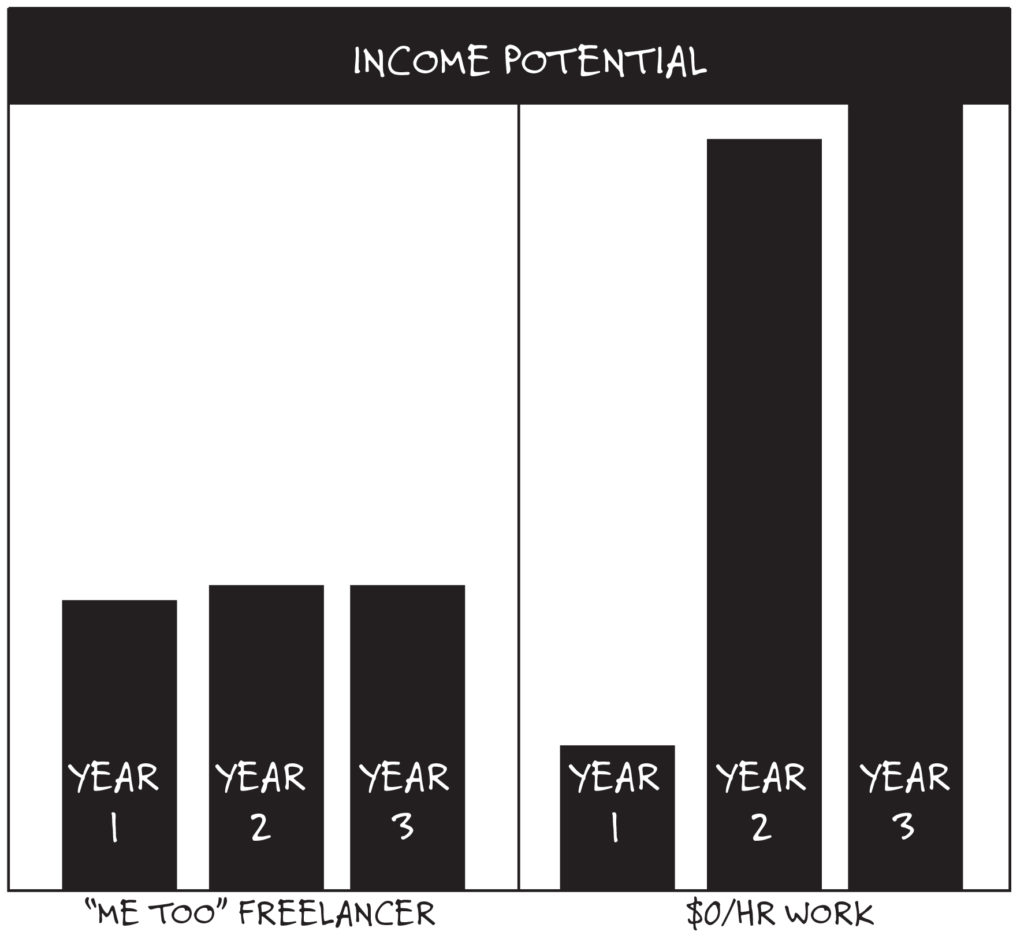

As I’m showing you sometimes when I bet I lose, and other times I win. However, it’s important to realize that when you’re betting on yourself your upside is uncapped. This makes all the difference. When you’re not betting on yourself(job, keeping money in the bank, etc…) your upside is ridiculously capped.

I started my sports card business as a kid for I believe $700. I started poker for $50. I started my poker business for around $20k. My e-commerce investment on my initial two stores was around $4.5k. So, if I lose, I lose these amounts. Cool. But if I succeed, my winnings are somewhat uncapped. Even moreso because when you succeed you can pour the income you’re producing back into what you know is a profitable investment to produce even more income. This creates a situation where when you find that you’ve bet on a winner, you can make a lot of money.

If you hit on a winner in a job, and you ask your boss for 10x your salary, what do you think they’re going to say? When they get done laughing if they even bother to give you a response they’ll tell you “of course not”.

Because you’re in a capped income situation you don’t reap the rewards when the upside pays off, the people renting your time do. They made the wagers, so they get the spoils when the bet pays off.

You may have less chance of a ‘loss’, but you have very capped winnings.

Investing in Yourself is Not Risky

“So is placing bets on yourself risky?”

It doesn’t have to be.

As you can tell I barely risked much money at all on some business ventures that have worked out. Most people would view my putting any winnings back into play as a risk, but my bigger risk would be the opportunity cost of leaving ‘safe’ money in a place where I guarantee myself low returns.

Even when you win at the safe route… are you really winning?

You just get the expected result of relatively low upside. You may lose less, but you often lose by default as a byproduct of never even giving yourself a chance to win the game.

I set up my poker ventures in a way that freed up my time to explore other opportunities, another benefit of betting on myself in the past, that continued to pay off in the future.

More time to do what I wanted, plus it allowed me the time to explore other business and investment opportunities.

One of these was e-commerce stores.

“Don’t you want to keep your money in the bank Billy, remember what happened with real estate?”

Logical Billy, “lol illogical Billy!

Let’s bet on myself.

I started off with a couple very small bets, and when I saw progress I bet even bigger. I ended up with around 20 stores.

It was less of a business and more of a micro fund, that I invested in/hired people to run. I learned a lot of lessons. How to hire(often how not to hire), how to manage(often how not to manage), lessons hammered home on why not to diversify, why you should work on things you’re passionate about, etc…

Even though it was mainly passive for me, I really didn’t enjoy it. Despite e-commerce stores being a relatively easy business model, I didn’t like it at all. I had no interest in the products being sold. I didn’t even log into my stores the whole time I owned them after the first month or two.

So despite making some money and having another passive business, I knew that wasn’t the answer for me.

So when things like the Amazon product wave got hot over the last few years, despite the great profit potential I knew I wasn’t interested and would be bored out of my mind.

Even if you can make money at something doesn’t mean you should do it.

And that was a lesson that took me much longer to learn than it should have, but I never would have learned it if I hadn’t been playing the game.

I’ve failed more than just about anyone, but those failures led to growth, and increased knowledge and skills. The increased knowledge and skills made it easier and easier the next time I place a bet on myself.

Continue to Invest in Yourself

If you’re continually investing in yourself, you can predict your own success.

Your success is just a result of the work you’ve done in the past.

ForeverJobless is my current project. If I’d never done anything before and was starting it with no knowledge I might mistakingly follow along with the ‘thought leaders’ in the space, telling people to start blogs and other things they shouldn’t be doing, and trying to get paid for doing so. I’m giving up a lot of short term income from not doing a lot of those things that I know I shouldn’t do, and I’m fine with that.

As you follow along with ForeverJobless you’ll see that not only is the content different than what others are putting out, but you’ll see different ways that I attempt to do things with ForeverJobless. Those bets are easier to make because of experience making outside the box bets on past projects. Some of them will fail, some will succeed and the ones that succeed will have a chance to reap rewards significantly greater than going the ‘standard’ route. Plus it’ll be more fun.

I already know what’s going to happen in the future. I’ll bet on myself when the odds are right to do so and I’ll pick up knowledge along the way that puts the odds even more in my favor … And if I fail along the way at times(which I will) it’s fine. There will occasionally be someone on the sidelines who’s like “ahh see! You shouldn’t have done that too risky!“.

And what does that mean when that happens?

You’ve identified an illogical thinker. Someone who thinks what you should have done is based on results from a sample size of one. Those are uneducated opinions from results oriented thinkers, and should be dismissed accordingly. They fail by default sitting on the sidelines thinking everything is “risky”. You occasionally fail but it’s just a learning experience that gives you knowledge for your next bet on the way to your successes.

Do not let illogical opinions incorrectly influence your path.

Remember the earlier quote:

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.

― Theodore Roosevelt

If you are not where you currently want to be, answer this with complete honesty:

Where would you expect to be given the cumulative result of all of your bets?

Are you anywhere different right now than where you would expect based on all of the bets you have made on yourself(or failed to make) in the past?

Over the long term, the bets that you have made, or lack thereof, have given you the expected results of those decisions. Usually nothing more, nothing less. In the short term, yes, you can and will get lucky and unlucky. In the long term, it evens out and the life you create as a byproduct of all of your decisions produce exactly what you could expect.

If you take a route that’s guaranteed not to give you the life you want, be careful not to fool yourself into thinking that you’ve done what was needed to have the desired end result.

“I would give anything to…”

As I mentioned earlier, all of your decisions in the past have answered exactly what you are willing give. If what you are willing to give does not equate to bets that are likely to produce your desired life, then you won’t have it. It’s not any more complicated than that.

Most people look for complexity in places where simple equations would eliminate confusion.

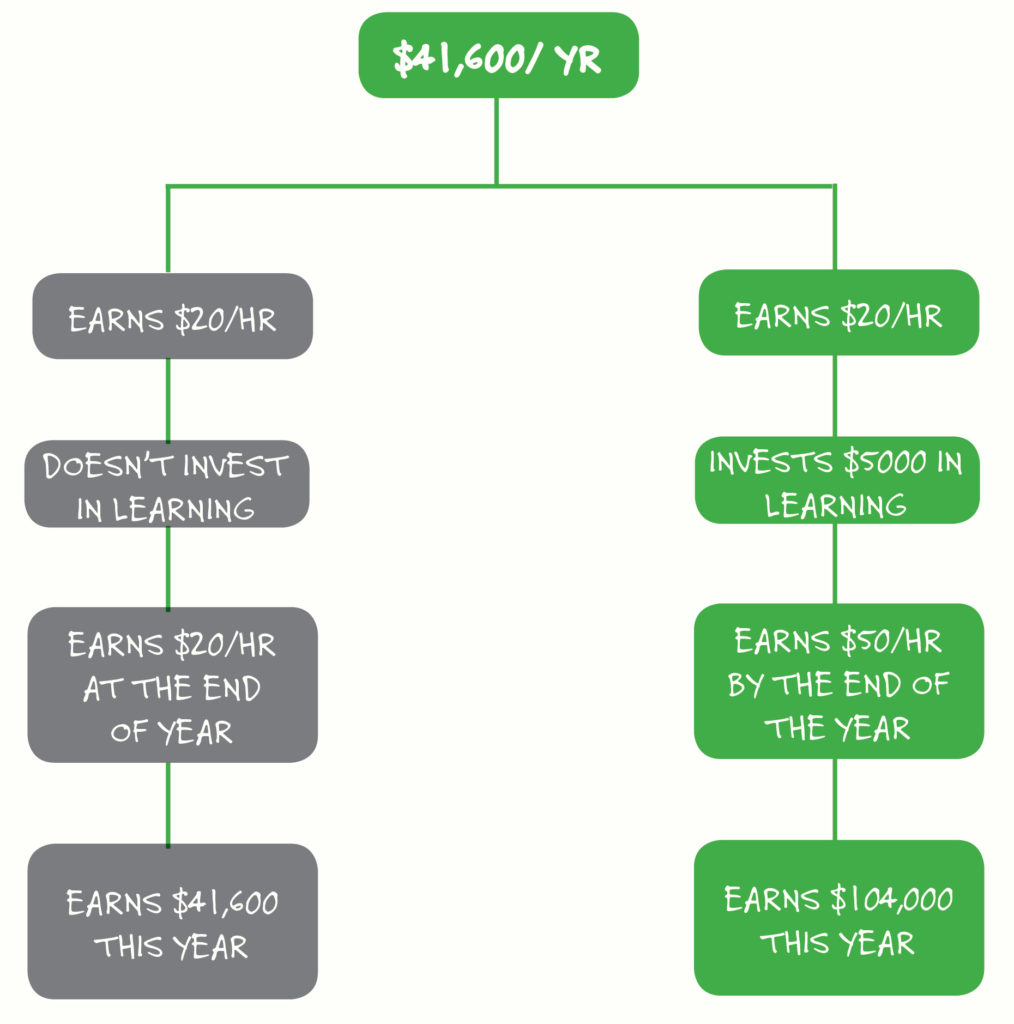

For a simple example let’s look at my route versus the traditional route.

When others got their first job, I did sports cards. ‘Safe secure’ job after college, I played poker. When others tried to work up the ladder, I started a company and bought real estate… I kept betting on myself.

I lost some, and won some. I learned a lot and my knowledge and skill sets grew which each bet, where others often stayed the same.

Is it luck?

I bet on myself, and was mathematically proven to win over the long term.

It’s not luck, it’s math. Even with any losses I take when bets don’t go my way, since my losses are capped and my winnings are uncapped it’s going to be very difficult to match the results of someone who’s betting on themselves versus someone who’s not. Plus the knowledge that’s picked up in the process is a completely different set of skills than the ones you get from renting out your time, and increases the payoff on future bets.

So, if you’re not where you want to be yet, instead of looking for some complex answer just ask yourself how your bets are going. If you don’t make any bets, they can’t pay off.

Over the past couple years if I’d see a friend of mine crushing it on a much bigger level than I had I’d find myself thinking, “oh man I wish I…” and then I catch myself. “Welp, let me look at the bets I’ve been making versus the bets they’ve been making…

“Oh, I’ve been traveling the world, spending most of my energy on fitness, dating, and whatever else.” They’ve been trying project after project and testing a bunch of different things out. How could I possibly expect my bets to pay off in a similar way to theirs? That wouldn’t be realistic. Their results were earned by putting in enough bets and picking up enough lessons and occasionally taking some big risks to get the huge payoff.

See results others are having that you wish was happening for you? Calculate the expected value of the bets they’re making versus the ones you are. It’ll likely give you a reality check pretty quick, and show you it’s not “wishing” that’s going to give you those results.

So, the next time you think, “Why is it easy for you Billy?”. “Why haven’t I found a good opportunity yet?”. Hopefully you realize it’s the bets I’ve made in the past that make the game easier for me. And finding a good opportunity has nothing to do with getting lucky or unlucky, it’s betting on yourself to create situations where you’ll be significantly more likely to understand what to do with opportunities when you come across them.

You probably see opportunities every day, but if you’ve never bet on yourself before you don’t even realize they’re opportunities.

Much like when I was doing sports cards, or elmos or anything else as a kid and thinking, “doesn’t anyone else see all these opportunities!?”.

The game is the same now as it was then. I’m just in different markets, with a lot more knowledge and playing with more zeroes if I see a good bet.

I see opportunities everywhere.

The people who’ve bet on themselves in the past understand opportunities when they come across them and often know what to do with them from their failures and successes in the past.

Those who continually pass up opportunities to bet on or invest in themselves remain blind to the goldmine of opportunities that surround them.

If you’ve never done anything, the odds aren’t just going to magically start shifting in your favor.

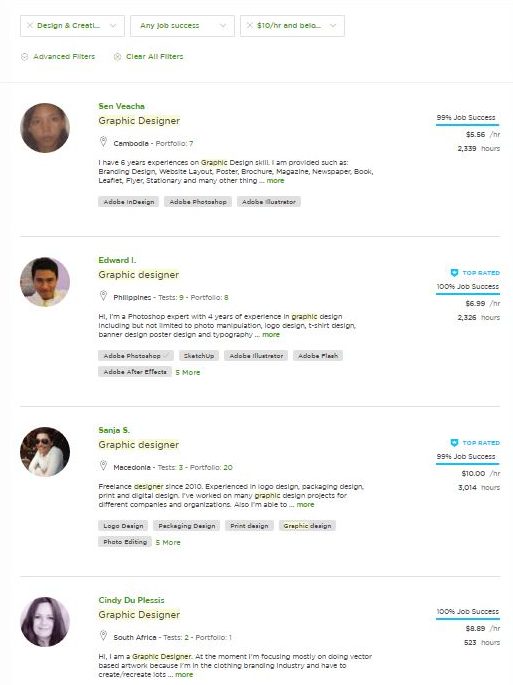

If you’re just starting out, here’s how the beginning of the game should be played:

- Put in the initial work to raise your knowledge up.(reading good books, articles, etc…)

- Use that knowledge to raise the level of your questions

- Getting answers to better questions will further your knowledge

- Higher level knowledge allows you to have higher level success

- Higher level success allows for even deeper questions, leading to higher level answers, leading to more success and the cycle continues…

Throughout the process occasionally bet on yourself. It doesn’t matter if it’s small, just invest in your success.

The cycle never even starts for those who won’t take the first steps.

I can always tell if someone’s put in any work by their questions.

“Hey Billy how can I make some money?” = never done anything.

They’d have a higher level question than that if they had. When I get those types of questions I often suggest reading all the articles I’ve written and then writing me back, and I’ve literally never heard back from any of them(hundreds). It’s often taken as “oh Billy must not want to help me”, instead of realizing that I’m trying to get you off the starting block to enable you to ask better questions to get you to that next step, but I can’t do it for you. You’ve got to want to do something for yourself.

The money isn’t going to just fall into your bank account one day. It doesn’t matter if you take baby steps along the way, those will add up. If you never take the first steps, you’ll spend your whole life crawling along wondering why others sprint by and enjoy the kind of life you wish you had.

Every action or inaction you take WILL lead you somewhere. Just depends if it’s where you really want to go.

Start betting on yourself, and I guarantee you’ll start reaping the rewards of those wagers, even if it doesn’t show up as money right out of the gate.

How?

Think about it like this:

Each one of us starts the game as an entrepreneur out with a coin. You are going to flip this coin every time you make a bet.

Heads you succeed; tails you fail.

The coin will not go your way every time. You will have some variance; the lesson is to get used to it.

Each time you play the game you will be handed the same coin, but it is not quite the same anymore.

Why?

In the game of business, the coin becomes weighted in your favor the more you play. The reason being that your knowledge acquired from past failures, coaches or mentors, gives you an edge you did not have before.

Consider this …

If you knew the expected value of the coin was weighted in your favor, and someone allowed you to flip for money as many times as you wanted, how many times would you bet? You would never stop, and by doing this would end up very rich. It would be mathematically impossible not to be.

It’s the same in business as an entrepreneur. Some people bet once or twice, and give up because the first few attempts didn’t go the way they wanted.

Some never bet at at all.

If you go into business with the understanding that you will occasionally lose, and that it’s okay, you’ll be mentally prepared to endure it. Don’t forget that in the game of business the more you flip the coin, the more weighted the coin becomes in your favor since you are learning as you play.

Once you flip, you will never play the game the same again.

You will be playing with a weighted coin.

So if you’ve never bet on yourself, get started.

If you’ve bet but haven’t hit on a success yet, keep betting.

The best bet you’ll ever make is on yourself, and when the payoff comes and outsiders see “luck”, you’ll know the reality.

It was the expected result from all the bets you placed.

Nothing more…

Nothing less.