I mentioned in my first post that one of the things I wanted to do here was to help you think outside the box. There is a reason successful entrepreneurs capitalize on opportunities other people miss. It’s important to not just look at what decision a good entrepreneur makes, but WHY they made it. What I’m going to share with you will help you begin to see things differently, and maybe allow you to attain some things you don’t currently think are possible. Enjoy.

About a year ago, I was scouring the web for some e-commerce stores to buy. I had only been doing online stores for a couple months, so I was still a bit of a newbie. I came across a deal that seemed appealing. It was in a niche I was somewhat interested in, and the owner was willing to sell at a low multiple. I was planning to offer around $100,000. I didn’t know if I wanted to put up all the money since I was still learning the ropes in this space. I decided to approach my friend about partnering, since he’d been in the e-commerce game for years.

My friend (we’ll call him K) is the perfect example of someone that lives the 4-hour workweek lifestyle. He travels around to different countries all the time, prefers to work very little, and often sets income goals just based on the things he would like to buy— whether it be a big vacation, a new toy, or in this case, a Ferrari. He works just enough to reach his goal, and enjoys the rest of his time.

I called K and told him about the potential deal. Because of the lifestyle he desires, he didn’t want to deal with the operations side. K was interested, but wanted no part in managing it. I was right in the middle of scaling up my store business, and already had employees handling operations. I told him I’d take care of that end, and explained that more than anything I was interested in him coming on board to hedge my bets. First, from the standpoint of me not wanting to put $100k into a business I didn’t have much experience with yet. Also, with his expertise in the deal, it increased the level of success the business could achieve. He said he’d call me back in 5.

The phone rang a few minutes later. K was in.

Here’s how the Deal Would Look

K would be putting up $20k, and would bring in another $30k from his friend.

He would help advise on the site, but would not have to manage any of the day to day. His other friend wouldn’t have to do anything, he just wanted to be in on the deal. I would put $50k in and be in charge of it. Because of what people were bringing to the table, here is what we agreed on:

K: 25%

Friend: 15%

Me: 60%

K: He gets in on a good deal without having to do much work. He makes an expected return on his money much higher than he can get elsewhere, in a deal with someone he knows. Because of the skin I have in the game, he can feel pretty confident that I’m going to try and make sure the business succeeds.

Friend: He gets a ride on a deal without having to do any thinking. He knows K well, and knows of me, so when he heard we were both involved in a potential deal, he said “let me in.”

Me: I give up 40% of the deal but limit the money I need to bring in and get a good adviser with skin in the game to hedge my bet of the business not succeeding. Normally I would hate hedging my bets on +EV(expected value) deals, but this was a rare occurrence where it made perfect sense.

note: I will be discussing the concept of EV more in depth in a future postSo, you’re probably asking…

“How is it that you can get a Ferrari for $20k???”

Let me explain.

K had been looking at a few Ferrari’s that had payments starting as low as $2k/month. The store was expected to sell for a low multiple, roughly 1x yearly income. Because of this, K could pay for the Ferrari with the income the business would kick off to him, with just a $20k investment, and no work, because of the deal structure.

note: K’s shares would have been expected to return him roughly $25k/yr, or $2,083.33/month

So…

With that quick phone call, we had the agreement on how we’d split up the deal. One catch was, he was leaving for Peru in the next day or two, and he wouldn’t be around by the time the owner was going to sell his site. With that in mind, we agreed on a max price we’d pay.

A few days later, the seller had someone agree to give him an amount that was higher than the max K and I were willing to go up to. If he was in town, we might have talked and decided to outbid the buyer, but we had a set number so we stuck to it.

So unfortunately for K, he was unable to come home from Peru to a Ferrari, but it was interesting to look at the deal like that. It was cool to see how little it would take to get something like a Ferrari just on the simple structure of a deal and the desire to have your money work for you and give you things that you’d like to have.

K’s logic was, why would he ever pay cash for something if he could just buy an asset that gave him what he wanted without tying up anywhere near the same amount of money. It leaves him with that cash to use for other deals that would get him a substantially higher return than if he just paid off the car.

Despite K not getting the Ferrari on this deal, there was a happy ending.

K had made a pact with himself at the beginning of the year. He set a goal that if he increased his income by a certain amount for 2011, he would purchase a Ferrari by the end of the year. Several months later, having not purchased an asset to buy his Ferrari for him yet, he reached his income goal and decided to go ahead and just buy the Ferrari anyways. Cash.

Despite K not acquiring the car in a creative deal through an asset this time, he easily could have waited and done a similar deal to the one we had looked into.

He was dumbfounded as to why more people couldn’t pull deals like this off…

“Why wouldn’t this work?”

“Why doesn’t everyone do this?”, he asked.

Valid questions, especially since most people don’t have the money available to buy a Ferrari in cash. They would however have a much smaller amount available to do the same sort of thing. They could buy an asset that would produce enough income that could pay for a Ferrari, or whatever else they wanted to buy.

note: I’ll discuss ways to find high yielding deals in a future post

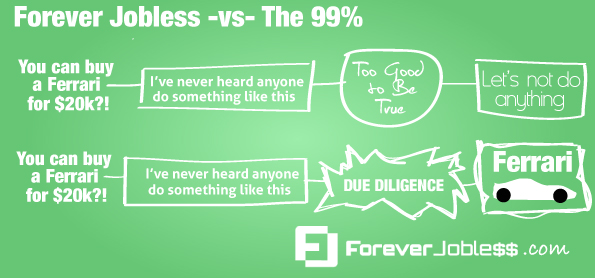

People are afraid to do things that are outside of their box.

Why doesn’t everyone do this, or at least put themselves in situations to be able to do this?

I believe their fear of failure along with their lack of knowledge outweighs their untrained logic. This keeps them from acquiring knowledge that would reduce their fear of failure, leading to action, which would lead to Ferraris.

He told some people about his intentions to do this initially, and many people didn’t believe it could be done. It was “too good to be true”, they said.

From my experience the deals that seem too good to be true, sometimes aren’t. But because others are regurgitating what they’ve heard and assume something must be wrong, it creates a window for people willing to dig in, research, and snap up steals. Often deals most people classify as “too good to be true” are easier to get than stuff that’s run of the mill. Everyone assumes run of the mill is legit, and “too good to be true” must not be. People like us can then swoop in and pick them up while everyone else is on the sideline instead of doing their due diligence.

[social_share/]

The risk tolerance most people have is not one that will allow them to be successful entrepreneurs, since they’re waiting for the sure thing instead of just taking a calculated, super +EV risk.

The first store that I purchased last year was for $4,000. Within the first 4-5 months I had already made my money back on the store. Since the purchase, I’ve made over $15,000 from that one store.

I can remember looking into it and figuring something must be wrong if they were willing to sell for that low. “They must be trying to rip people off.” Or, “there must be some sort of a catch” is usually the first thought that goes through your head when things seem too good to be true. However, that’s usually what stops other people from doing the research necessary to determine if something IS off, or if it’s just a good deal that other people have passed over because of incorrect assumptions.

I decided, what was the worst that could happen? I lose $4k. What’s the best that can happen? I have a site that kicks off $10,000+ per year relatively passive, and I learn a bit about e-commerce stores to see if that’s something I wouldn’t mind doing. I did my due diligence, and it seemed like a good bet to make, so I made it. Even if it hadn’t worked out, was it the wrong decision?

Even if there was some catch I missed, and I lost everything on the deal 50% of the time, that deal is still very profitable.

50%: -$4k

50%: +10k

EV = +$3k

The simple math would tell you that even in this horrible case scenario, the first year your EV would be +$3k. That’s only IF you were going to lose all your money 50% of the time, which isn’t going to happen.

This calculation is also not factoring in that when you don’t get ripped off, the site is still making you money long term, and you still have an asset. So this decision should be a no-brainer, yet most people decided not to buy it because it “seemed too good to be true.”

It’s important not to be results oriented in business. Even if I lost money on this deal, it was the right decision to pull the trigger. It has very little to do with the end result of the investment, and mostly everything to do with the decisions that led you to that result. The final outcome is usually irrelevant. In the long term, everything works itself out if you are putting the work in and consistently making +EV decisions.

Don’t let emotion get in the way of making money. Some simple math will tell you everything you need to know, and it’s often going to lead you in a different direction than your initial emotional response would have.

You will have much better end results once you start making decisions logically instead of emotionally.

Whether it’s a Ferrari you want, or maybe you just want to build up some passive income.

—

Back to K’s original question.

Why wouldn’t this work?

Why aren’t you doing this?