Have you heard of the term sunk cost fallacy before? Many people haven’t, and even if you have you may not fully understand the impact it has on your life. In this article I’m going to explain how it may be controlling major life decisions of yours in very negative ways, without you even realizing it.

What is sunk cost?

Sunk Cost Definition

The definition of a sunk cost is a cost that has already been incurred and cannot be recovered. So, why is this important? Well, most people fall victim to sunk cost fallacy, which means we often make incorrect decisions when it comes to sunk costs. We incorrectly value the sunk costs we have as more than $0, which leads us to suboptimal decision making. Even people who understand expected value(EV) can fall victim to this trap. We’re wired to believe that the time or money we already have invested into something should be factored into our current decision making. This is flawed logic.

This is a bigger problem than you realize, and it’s negatively impacting your life. Sunk cost fallacy leads to -EV decisions, which leads to suboptimal results, which leads to decreased long term happiness.

Take your average entrepreneur. I can’t count how many times I’ve heard, “but I’ve already invested X amount of dollars”, or “but I’ve already spent Y amount of hours”. Well, the previous time or money spent should be irrelevant to future decision making.

A lot of people allow their past to determine their future, and I don’t mean that as some regurgitated inspirational quote. I mean that specifically related to sunk cost fallacy and the impact not overcoming that mentality has on your results.

I know of many people who’ve invested money into a project, and incorrectly make future decisions based on feeling committed to the project, even after realizing it probably wasn’t optimal. Just because you happened to make a -EV decision in the past, doesn’t mean you should keep making -EV decisions.

It’s the sunk cost fallacy at work. We tend to compound our mistakes because of our failure to separate emotion from logic when in the moment. We compound -EV decisions, with more -EV decisions. Sunk cost bias has a crippling effect on the illogical mind.

Let me do a thought exercise with you. Let’s pretend you have three projects going on. You have $1,000 invested in one project, $5,000 invested in another, and $25,000 invested in the third. I tell you that you have to eliminate two of the projects, and only focus on one.

Which do you choose?

Well, if you’re like most people, you’d answer this question without even asking for more information. You don’t even know the EV of each project or your level of enjoyment from them. Not only would most people answer the question with no hesitation, pretty much everyone would choose the project they’d invested $25k in, even if the expected value or happiness from the other projects were higher. Sunk cost bias has enormous control over most people’s minds, influencing them to make incredibly flawed decisions.

At the risk of getting too philosophical on you, let me bring up one other reason the sunk cost fallacy often controls our decision making. A lot of times we make the irrational decision to succumb to sunk cost bias because subconsciously we may feel the need to justify our decision to irrational people. If someone can’t think logically, they won’t understand why you spent money on a project, then didn’t do anything with it. That’s illogical to them. Well, for a logical person, it’s illogical to think that’s illogical.

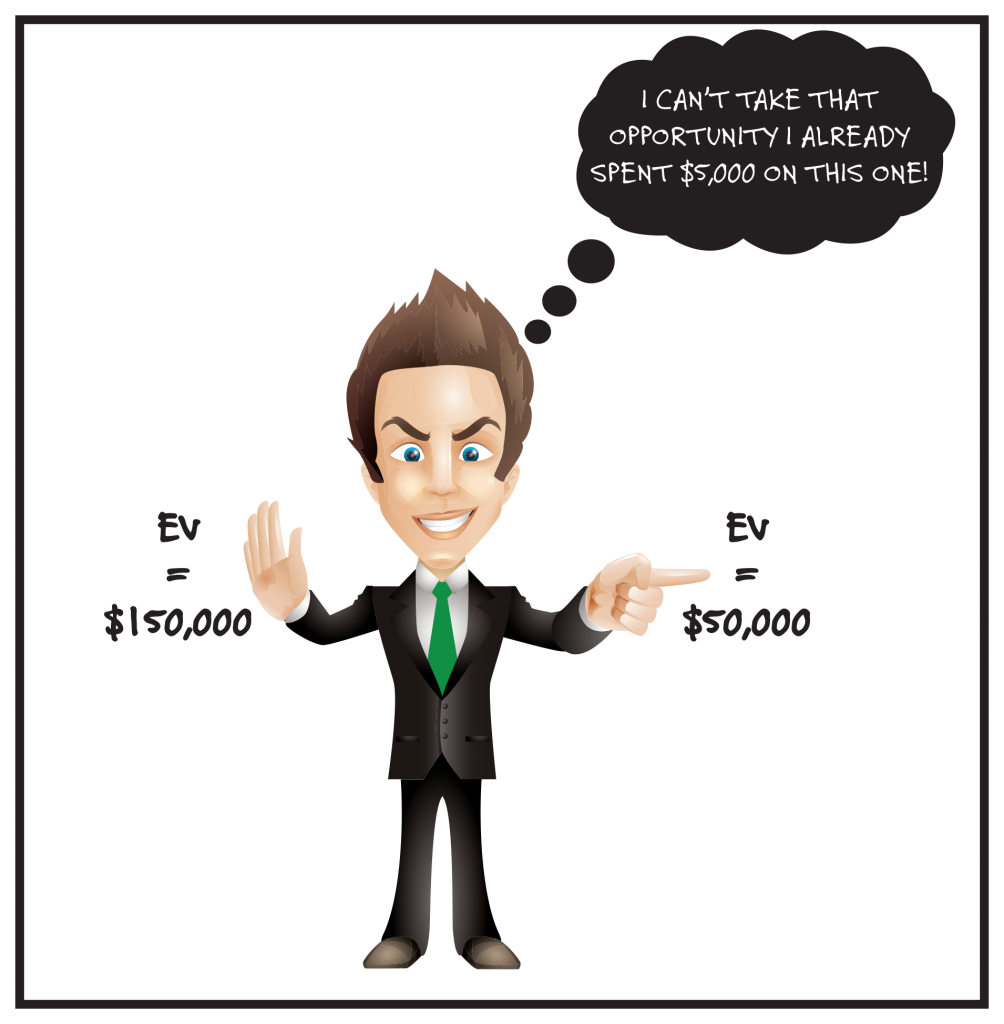

Most people want to conceal what could be conceived as a mistake. We may not have even made a mistake, it might have been +EV at the time, but is no longer +EV based on changes in the market or new information we didn’t have before. Or, we may have discovered better opportunities, so maybe it is still +EV, but no longer +EV relative to the new opportunities. The opportunity cost of bypassing a higher EV option is essentially choosing a -EV option, no matter what your sunk cost is. It’s a sunk cost, it is irrelevant. If you already invested $5k in a project where the EV is $50k, and you find an opportunity where all else is equal(time, happiness level, etc…), but the EV is $150k, most people would let the $5k they invested on the previous project keep them from gaining an extra $100k on a better opportunity.

Sunk cost bias would convince them that they can’t give up the initial project or they’d lose $5k. Most people have not trained their mind enough to overcome the sunk cost fallacy to make an additional $100k. Also, even if the monetary expected value has not changed, if your happiness EV(which I’ll write about in an upcoming post) has changed relative to where you’ve invested time or money, you should still cut your losses.

Sacrificing money or time because of a sunk cost bias is an amateur move, that even most professionals make.

Sunk Cost Fallacy Examples

There was a popular study done a long time ago that confirmed how strong of a hold sunk cost fallacy has on our minds. Hal Arkes and Catehrine Blumer did an experiment several decades ago about the psychology behind sunk cost. Their study asked subjects to assume they had purchased tickets for two ski trips. One was a trip for $100, and a second, even better trip for $50. The subjects soon realized that the two trips actually overlapped, so they could only go on one of them, and neither ticket could be refunded or resold. The majority of the people in the study chose to attend the less enjoyable trip, because it was more expensive. The loss seemed greater to them, even though there was no actual loss, it was just the sunk cost fallacy playing tricks on their mind. They couldn’t get the money back from either trip, and they still chose not to attend the trip they would enjoy most. They let their past decisions incorrectly influence their future decisions, and future happiness.

It’s pretty mind boggling that we’re wired in a way to make suboptimal decisions even when we know exactly what we want. I believe we can overcome the sunk cost fallacy with practice. Starting with small decisions, and working our way up to where it’s natural for us to think in terms of expected value, instead of being influenced by sunk cost bias.

Let me give you an example from my own life where I practiced not falling victim to sunk cost fallacy with a conference I was supposed to attend:

See, there was a conference I was supposed to go to. I had purchased the ticket a while back, but decided it wasn’t a good use of my time.

So, I threw the $500 ticket in the trash.

Why?

Well, based on a lot of my goals changing, conferences don’t serve me much at the moment. It would have been a distraction for me.

I had many friends who couldn’t believe I was going to throw away a $500 ticket.

In hearing that I wasn’t going to attend, more than once I heard something along the lines of, “I don’t really want to go either but I already spent $500.”

That’s the sunk cost fallacy at work. Not only that, if a conference no longer serves someone, they’re losing even more in opportunity cost by allowing sunk cost bias to control their decision making, not to mention that the same people spent even more money doing something they didn’t want to do by buying plane tickets and hotels. Think about that. They admittedly didn’t want to go, but since they spent $500 they don’t want to feel like they lost it, so they spend another $500-$1,000 on room and airfare!

Me attending the conference would have been me saying, “I will let a sunk cost that no longer serves me convince me to make a -EV decision so that I won’t feel like I lost money on the ticket”. The problem is, that decision to let a past decision influence future decision making is actually costing me money. Not just money, but time and happiness, since I know it no longer serves me.

Remember I’m not losing $500, it’s a sunk cost.

I think a lot of people feel obligated to stay committed to certain things just because you have a sunk cost, even when it’s obvious that it won’t help you achieve your goals.

Let’s look at some common examples where you may be allowing the sunk cost fallacy to negatively influence your life:

Relationships:

How many of us have stayed in crappy relationships because we’ve invested so much time already? Even when it’s obvious it’s not a fit, we choose to continue because we feel like we’ve already invested so much in it. Instead of freeing our time for someone who’s a better fit, we stay involved with someone who’s obviously not because of sunk cost bias.

Not just romantic relationships, but friendships as well. How many friendships that do not serve you are you still holding on to because of the time you already invested? You’re allowing bad choices from the past to determine future choices, even though these future choices will negatively affect your happiness. Eliminating sunk cost bias from your thinking helps you eliminate bad decisions. Eliminating bad decisions helps you increase good decisions. Increasing good decisions will ultimately increase your happiness.

Investments:

Let’s say you invest in a stock, or a piece of real estate, and you realize it was a bad investment, and may not end up doing very well. If you have already lost money on the investment, you may be inclined to stay in the investment even though you already know it’s not a good one. You’ll incorrectly want to make your money back before you get out, instead of making the correct decision to just get out. In a stock, you may watch it continue to go down in value, not selling because it’s not back to the price you paid. The price you paid is irrelevant, yet that is how you are wired, to continue losing money as if the price you paid mattered. In real estate, not only will you lose money on a bad purchase, you’ll probably end up going even further into the hole, as you’ll need to continue dumping money into it to hold it. Throwing good money after bad is obviously -EV, but most people have not trained themselves to overcome sunk cost bias, so they do it anyways.

They may as well be gambling, and this mindset is relevant to the gambler’s fallacy:

Gamblers Fallacy

The gambler’s fallacy is the mistaken belief that something with a fixed probability will start happening more, or less, based on past results. For example, a coin flip is heads five times in a row. You’ll see the gambler’s fallacy at work when you hear someone say, “oh, it has to be tails this time”. The past results haven’t changed the fact that it’s still 50/50.

When I played poker for a living, I profited from the gambler’s fallacy many times. Players would have trouble walking away from the table when they were losing, even if they were at a big disadvantage. Their mindset was, “I just need a couple big hands to get back to even”, even though it was unlikely they’d make their money back since they weren’t skilled enough to be a winner in the game. Their sunk cost fallacy of being down money, combined with their gambler’s fallacy of ‘being due a good run of cards’, kept them at the table, which often resulted in much greater losses. Good for me, bad for them.

The gambler’s fallacy is also called the Monte Carlo fallacy because of what happened at the Monte Carlo Casino. In 1913, some gambler’s lost millions at the roulette table when it spun black 26 times in a row. They kept betting more and more money thinking it had to land on red the next time. While the probability of it coming up black 26 times in a row is extremely unlikely, the probability of each following spin did not improve based on past results, it stayed exactly the same. If they’d understood the gambler’s fallacy, as well as not getting caught up in the sunk cost fallacy of needing to make their money back, they would have saved millions of dollars.

Consumption:

‘I must consume, because I have purchased’ is a common way of people falling to victim to the sunk cost fallacy. Watch someone at a restaurant attempt to eat all their food even though they are already full. Even people who are on a diet often allow this bias to control their actions: “I need to finish my plate”. They even attempt to justify it with illogical statements like, “there’s people starving”, as if that’s related to their decision. Well, then how does eating it help them? A more logical question would be how to get the food you won’t finish to the starving people if that’s a real concern of yours, otherwise you’re just making illogical statements while getting fat.

Endowment Effect

Like anyone else, I’m often bad at throwing things away. I’ve got all sorts of clothes that I never wear. So, why do I still have them? For some reason I still value them, even though they’re of no value to me. The reason for this is less related to sunk cost fallacy, and more about the endowment effect, which is when people place more value on things they own, only because they own them. The reason I wanted to include this example is because it relates to the mindset entrepreneurs have about projects they’re involved in. They tend to hold on to projects they shouldn’t be involved in because of a combination of the sunk cost fallacy, or how much time or money they have invested, and the endowment effect, where they’re overvaluing the project, only because of their ownership in it.

A long time ago my mom taught me a good way to deal with my clothes, that I think will help you deal with your business decisions. She said, “if you saw this shirt in the store today, would you pay $5 for it?” I was amazed how many clothes I wanted to hang onto, that after applying the $5 rule to, I quickly got rid of. I was able to fill up many bags of clothes to donate, that would have just collected dust in my closet.

How can you apply the $5 rule to your current job or business situation? Let’s take a look:

The sunk cost fallacy of your job or business venture

This is probably one of the most vital for you to think about. A common line of thought:

“I’ve been at my job for X years already, I can’t leave now.”

It’s irrelevant that you made the bad decision of getting that job in the past, don’t continually make more bad decisions because of your sunk cost bias. Maybe it was a good decision for you at the time but you’ve since realized you want more out of life. Great, make the decisions that allow you to get more out of life. Every day that you wake up and fail to leave your job or business if it’s not the optimal situation for you, you’re likely falling victim to the sunk cost fallacy.

If you’re involved in a job that is no longer a good one, or no longer makes you happy, you need to leave it. It does not have to be more complicated than that. Don’t allow the time or money you have previously invested to influence your future time and money commitments. Always make the +EV decision.

If you’re an entrepreneur, it’s the same for you and your business venture. It does not matter what previous time or money you have into something. The sunk cost fallacy will only confuse your thinking in a way that leads you to less profits, or less happiness.

So, how would I apply the $5 rule to your job or business venture?

I would ask the question that if I had never been involved in the project up to this point, would I still want to get involved? Would you pay to get involved, or is it no longer as enticing when you’ve eliminated sunk cost bias from your thought process? You’ll find that it has often lost it’s appeal.

That shouldn’t be viewed as a bad thing. It’s a good thing, because sunk cost fallacy was influencing your decision of what you should be working on. With the sunk cost bias eliminated it will allow for more clarity as to what you should actually be doing.

Still having a hard time overcoming sunk cost bias with your current opportunities? Try this:

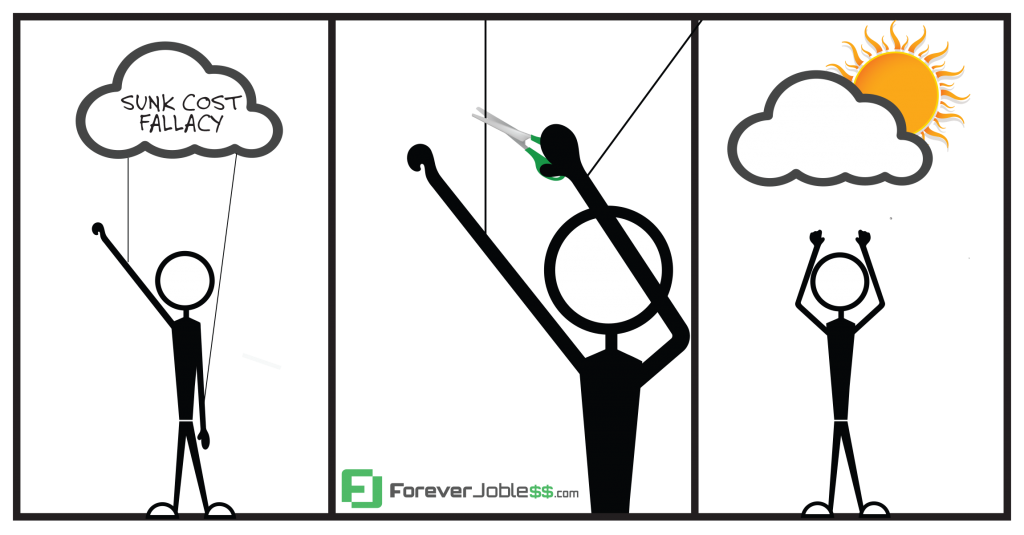

Write down every project you’re involved in. Imagine you are no longer allowed to be involved in any of these projects. Next to each project, write down exactly how much you would pay to get back in. It’s a quick way to get honest with yourself. If you’re not willing to pay good money to be involved, there’s a good chance sunk cost fallacy has a hold of you, or else you’d already have quit being involved. This should help give you clarity about which projects you should actually be working on. If there’s projects on the list that you wouldn’t be fighting to get back in, you shouldn’t be letting the sunk cost fallacy hold a cloud over you and be using you as a puppet to work on projects you shouldn’t be in.

Can you ever use the sunk cost fallacy to your advantage?

Yes!

Sometimes having a sunk cost bias can be good. Now that you understand that our mind is made to react in this illogical way, you can actually use it to your advantage. Let me give you an example:

If you invest in a gym membership, you’ll feel more obliged to go, when you normally might have stayed on the couch. The same sunk cost fallacy justifications you use against yourself, can be used for you as well. You’ll be likely to justify going to the gym with statements such as, “oh, I have to go to the gym today I already paid”. Even though you having paid is not relevant to whether or not you go to the gym today. You’re allowing sunk cost bias to influence your decision, which happens to be a good thing in this case.

I’ll purposely put myself in this situation. I travel often, and one of the first things I do is to get a gym pass somewhere. I know it will make me want to go, simply because my mind doesn’t want to feel like I’m losing something by not using it. Short term memberships are often more expensive, and I’ve found that the more expensive it is relative to what a normal membership would be, it actually increases the chance you’ll go. For example, last year I was in Melbourne, Australia for a few days, and I bought a three day pass to a gym for around $40. That’s a lot for three days in the gym, so even though I fully understood the sunk cost fallacy I could feel myself being more driven to go to the gym because subconsciously I felt like I was wasting $13/day if I didn’t go. So, sometimes sunk cost fallacy can be helpful, and you can use it to your advantage.

Whether that’s investing in a gym membership, a trainer, a business coach, or something else where you can take advantage of the flaws of your mind, for your own benefit.

Take advantage of the flaws of your mind, for your own benefit.

What to remember about the sunk cost fallacy:

Whether it’s money or time related, you need to consider the influence sunk cost fallacy has on your mind. Consider the opportunity cost of operating with sunk cost bias driving your ship, instead of logic. Correctly evaluating your expected value, and opportunity costs will help you.

Don’t think like this: “I’ve already got $5,000 into it, I need to make my money back first before I can move on.” Well, no you don’t. If it’s a crappy business project you’ll make $5,000 back much faster by focusing on a good one.

“But I’ve already got 6 months into this idea, I have to make it work!”. The months you have into something is irrelevant to whether or not you should be spending future time on it.

Think like this instead: would I still invest in this project if I wasn’t already involved? Disregarding previous time and money invested, how does this compare to other opportunities?

A lot of people’s failure to understand expected value means they consistently make -EV decisions, that they attempt to justify with emotional rationalization, a common one being sunk cost fallacy.

The funny thing is any time you allow sunk cost fallacy to influence decisions, you’re actually going to make it harder and harder on yourself to let go in the future. Essentially, falling victim to sunk cost bias not only means you’re making a -EV decision now, but increases the chance you’ll make a -EV decision in the future because at that point you’ll be even more invested.

Is there anything you’re currently spending time, or money on, that one of the main reasons you’re doing so is because of the time or money you already have invested?

If so, I urge you to step back from what you’re doing, and evaluate the situation logically.

Is this the best use of your time, or money at the present moment?

If not, for your financial future, and happiness, it is imperative that you realize sunk cost fallacy is driving your ship, and you must take over the wheel. You will make substantially more money long term if you understand the concept of sunk cost fallacy, and more importantly how to make sure you only let it influence your decisions when it’s to your advantage. The rest of the time you need to make sure it’s not taking you off course.

This will open you up to more + EV opportunities, and less stress.

More +EV decisions + less stress = increased happiness.